Bridging Loans

Better Loan Solutions in Mornington Peninsula • Learning Centre • Frequently Asked Questions

A Bridging Loan is a short-term loan that can help you finance the purchase of a new property while you sell your current property.

Most people sell their old home first, and then buy their new home with the available equity.

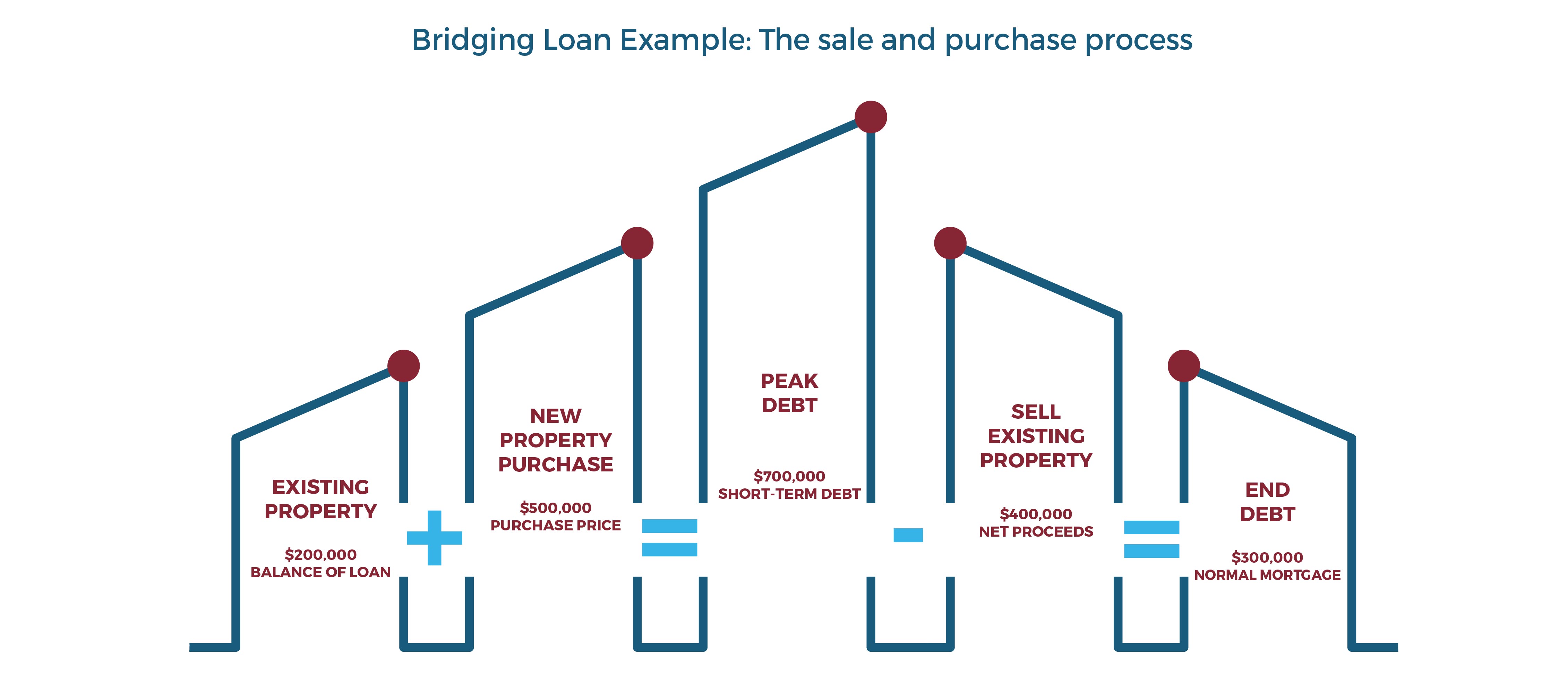

Bridging Loan Example

If the balance of the loan on your existing property is $200,000 and the funds required for the new property are $500,000. You may be able

to borrow up to $700,000, which will be your Peak Debt.

Currently, you have a short-term debt of $700,000, which incurs interest, while you await the sale of your existing property.

If you have chosen to capitalize the accruing interest on the Peak Debt (provided your lender offers this option), the debt will continue to grow until you begin making repayments or until the sale of your current property is finalized.

For the sake of simplicity, let's assume that you have been making interest payments and the Peak Debt remains at $700,000. Suppose the net proceeds from selling your existing property amount to $400,000, and you use the full amount to reduce the Peak Debt. In that case, you will be left with an End Debt of $300,000 (which is calculated as $700,000 minus $400,000).

Your End Debt becomes a standard mortgage product as adviser by your mortgage broker, with regular repayments.

This is general information only and is subject to change at any time. Your complete financial situation will need to be assessed before

acceptance of any proposal or product.

Working with a mortgage broker can help make the bridging loans process easier and help you find the best products for your needs.

When considering a mortgage, it's advisable to research different lenders and their product offerings to determine if they provide offset accounts as an option.

.jpg)

Several costs come with refinancing a home loan, although some of these costs are added to your new mortgage. You can get a rough estimate of the cost to refinance your mortgage by using a refinance calculator, or engaging a mortgage broker.

On settlement day, it's important to consider tasks such as reviewing the final settlement statement, ensuring funds are available for the down payment and closing costs, and conducting a final inspection of the property before completing the purchase.

A reverse mortgage is a type of loan that allows homeowners who are typically 62 years or older to convert a portion of their home equity into cash.

Mortgage refinancing is the process of replacing an existing mortgage with a new loan, typically to secure better terms, lower interest rates, or access equity in the property.